DISCOVER THE TOP PET INSURANCE PLANS: PROTECT YOUR FURRY FRIEND

Pet owners know the importance of ensuring their pets are well cared for, but the cost of veterinary care can be a heavy burden on families. Fortunately, several government programs offer pet insurance benefits to help pet owners reduce financial stress and ensure the health and well-being of their pets. Here are some specifics.

Protecting Your Furry Friend: Navigating Pet Insurance Options

Pet insurance is becoming increasingly popular among pet owners who want to ensure their beloved companions receive the best possible care without breaking the bank. As veterinary costs continue to rise, having a reliable pet insurance plan can provide peace of mind and financial security. This article will explore the world of pet insurance, helping you understand its benefits, choose the right plan, and make informed decisions about your pet’s healthcare.

Why Pet Insurance Matters

Pet insurance is designed to help cover the costs of unexpected veterinary expenses, from accidents and injuries to illnesses and chronic conditions. By investing in a quality pet insurance plan, you can protect your furry friend’s health while safeguarding your finances. Many pet owners find that insurance allows them to make medical decisions based on what’s best for their pet rather than what they can afford out of pocket.

Understanding Pet Insurance Coverage

Pet insurance policies typically cover a range of services, including diagnostic tests, surgeries, medications, and treatments for accidents and illnesses. Some plans also offer coverage for routine care, such as vaccinations and annual check-ups. It’s important to carefully review the coverage options and exclusions of any policy you’re considering to ensure it meets your pet’s specific needs.

Factors to Consider When Choosing a Plan

When selecting a pet insurance plan, there are several key factors to keep in mind. First, consider your pet’s age, breed, and overall health, as these can affect both the cost and availability of coverage. Look at the policy’s deductible, reimbursement rate, and annual or lifetime limits. Additionally, pay attention to waiting periods, exclusions for pre-existing conditions, and any breed-specific restrictions.

Top Pet Insurance Providers

The pet insurance market offers a variety of options from reputable providers. Some of the top-rated companies include Healthy Paws, Trupanion, Nationwide, and Petplan. Each provider offers unique features and benefits, so it’s worth comparing multiple options to find the best fit for your pet and budget.

Tips for Maximizing Your Pet Insurance Benefits

To get the most out of your pet insurance policy, consider enrolling your pet while they’re young and healthy to avoid exclusions for pre-existing conditions. Keep detailed records of your pet’s medical history and submit claims promptly. Some providers offer discounts for insuring multiple pets or for paying annually instead of monthly. Regular preventive care can also help keep your pet healthy and potentially reduce the need for costly treatments down the line.

Comparing Top Pet Insurance Plans

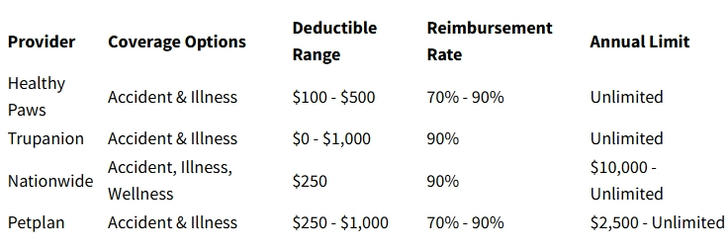

When it comes to choosing the best pet insurance plan, it’s essential to compare the offerings of different providers. Here’s a comparison of some popular pet insurance plans available in the market:

Note: The information provided in this table is based on general offerings and may vary. Costs and coverage details can change, so it’s recommended to check with each provider for the most up-to-date information and to get a personalized quote based on your pet’s specific details.

Applying for Pet Insurance Benefits

Once you’ve chosen a pet insurance plan, the application process is typically straightforward. Most providers offer online applications where you’ll need to provide information about your pet, including their age, breed, and medical history. After enrollment, there’s usually a waiting period before coverage begins. When you need to use your insurance, you’ll pay the vet directly and then submit a claim to your insurance provider for reimbursement.