Unlocking Homeownership in 2025: Bad Credit Home Financing Solutions Explained

Navigate the world of bad credit home financing can be daunting, but you must know that you are not without options. Subprime mortgage options and government-backed loans like FHA or VA offer avenues for those with poor credit histories. Consulting with a financial advisor and exploring offers at local credit unions can uncover opportunities that are often overlooked. Strategic approaches, such as larger down payments, can mitigate the higher interest rates typically associated with bad credit home loans. In 2025, homeownership can become a reality despite credit challenges, with perseverance and research.

It can be difficult to get a home loan for someone with a bad credit score, but it is not impossible. A variety of options and strategies can help people with lower credit scores get a home loan. Home loans for bad credit are specifically targeted at those who may have faced financial hardships in the past but still desire homeownership. Understanding these options and how they work is essential to making an informed decision.

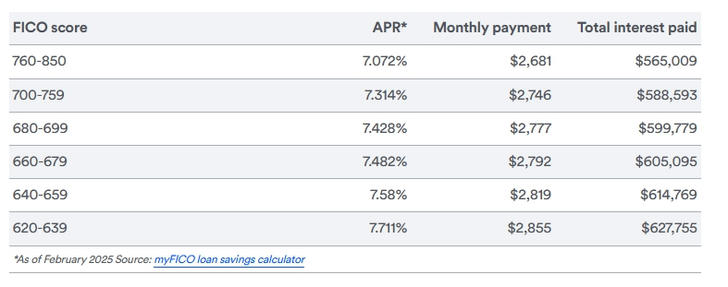

How much will a low credit score cost you?

A poor credit score will primarily cost you in the way of a higher interest rate. Here’s an example assuming a 30-year conventional loan for $400,000:

Can I get a mortgage with bad credit?

When you apply for a mortgage, lenders will check your credit history to see how well you manage your finances. They will also need to look at your income, monthly expenses and savings - your income and expenses. This is to make sure you can afford your monthly repayments, especially if your circumstances change - such as interest rates rising or your income falling.

It is possible to get a mortgage even with bad credit, but it helps to put your best foot forward. This means paying attention to your credit history and budgeting sensibly.

• Show lenders that you are a responsible borrower by paying all regular payments (such as utility bills and credit card payments) on time and in full.

• Review your spending - try to keep expenses to a minimum and keep your monthly spending steady. Aim to have money left over at the end of each month.

• Try to check your credit report regularly - make sure it is up to date and that the information in it is accurate. If you find anything that needs to be corrected, contact the lender in question and request an amendment - or contact Experian and will speak to the lender on your behalf.

• If you have a reasonable explanation for past financial difficulties (such as a layoff or poor health), consider adding a correction note to your report for the lender to see.

• Just keep your sights on properties you can realistically afford, as there aren’t many mortgages available at 95-100% loan-to-value.

• You may need a guarantor, usually a parent or older relative, to reassure the lender that they will cover the monthly repayments if you can’t make them on time.

• You can check if you qualify for a mortgage with Experian. Whether you’re a first-time buyer, moving home or looking to refinance,Can tell you which lenders are more likely to accept your loan.

Subprime Mortgage Options

For individuals with lower credit scores, subprime mortgages can be a viable path to homeownership. These loans typically have higher interest rates than traditional loans, but can provide funding that would otherwise be unavailable. Lenders that specialize in subprime mortgages may offer flexible qualification criteria, making it easier for people with bad credit to obtain financing.

Explore Home Loans for People with Bad Credit

Those seeking a home loan due to bad credit should consider speaking with a financial advisor who specializes in this type of loan. An advisor can help you understand the market and find lenders willing to extend credit based on nontraditional factors. Local credit unions or community banks may also offer opportunities that larger banks don't.

Low Credit Home Financing Strategies

While mortgage rates tend to be higher with bad credit, there are ways to reduce the overall cost. For example, a higher down payment can sometimes make up for credit issues and may result in better loan terms. Refinancing after your credit improves may also be an option to reduce your monthly payments.

Home Buying Options with Bad Credit

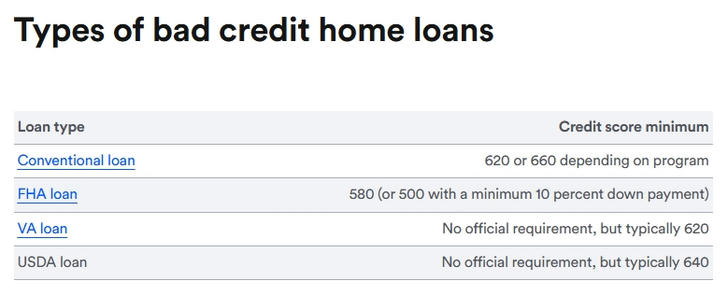

Government-backed loans, such as FHA or VA loans, are often ideal for individuals seeking home buying options with bad credit. These loans typically have less stringent credit requirements and lower down payment requirements. Researching these options is essential for anyone with a low credit score seeking to buy a home.

In summary, while searching for a bad credit home loan may require additional research and patience, there are options for individuals who are determined to purchase a home. Evaluating subprime mortgage options, exploring bad credit home loans, and exploring low credit home financing programs can help individuals achieve their homeownership dreams in 2025. More information can be found on bankrate website.